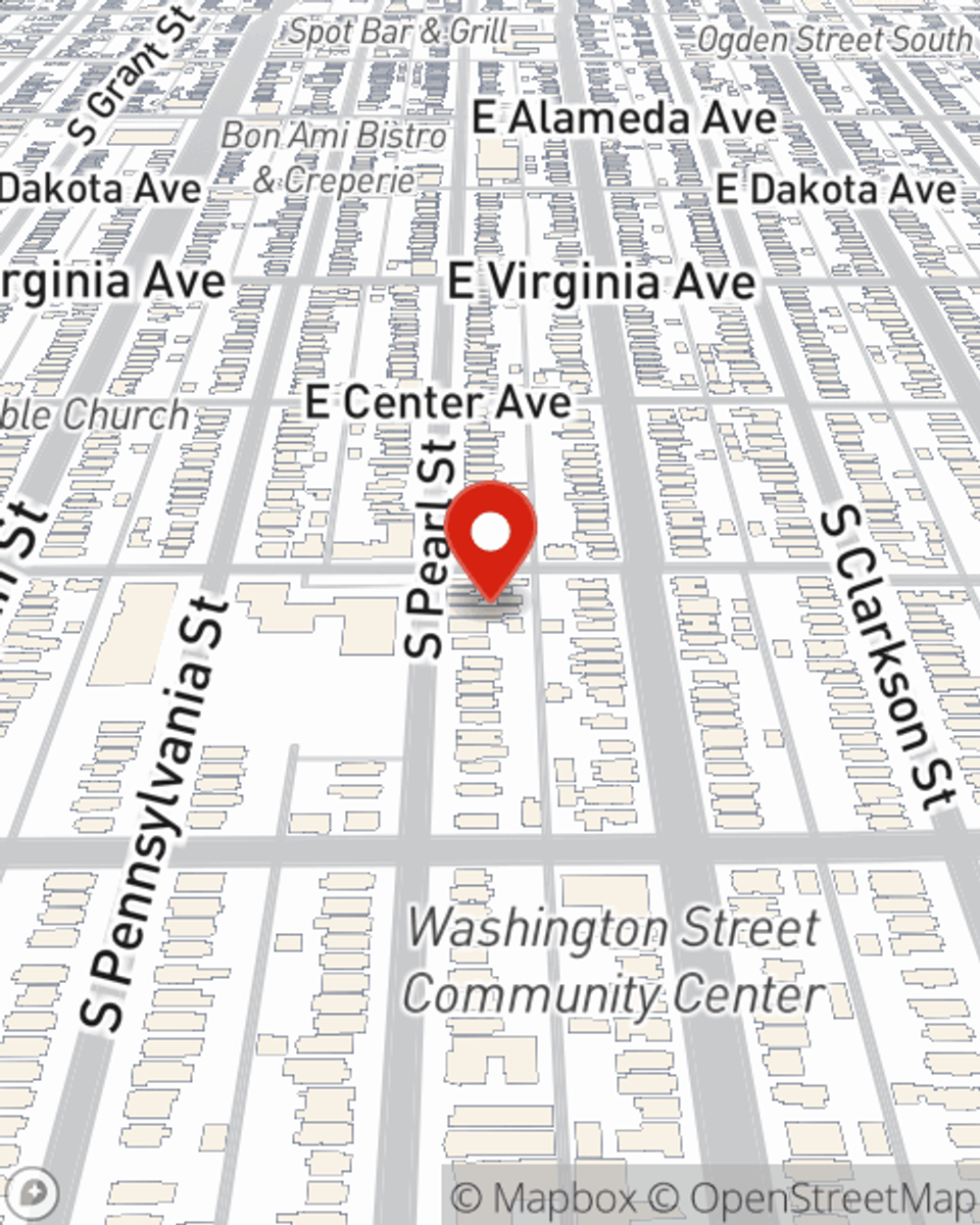

Business Insurance in and around Denver

Calling all small business owners of Denver!

Almost 100 years of helping small businesses

- Denver

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, a surety or fidelity bond and worker's compensation for your employees, among others.

Calling all small business owners of Denver!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Lori Rickert for a policy that protects your business. Your coverage can include everything from extra liability coverage or business continuity plans to mobile property insurance or employment practices liability insurance.

Call Lori Rickert today, and let's get down to business.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Lori Rickert

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.